Foreign real estate investors are increasingly turning to the U.S. rental market for its potential. But with this comes the challenge of understanding and navigating holding entities to ensure their investments and themselves are secure. In this article, we’ll look at the different legal structures available to foreign investors in the United States, so you can make an informed decision regarding protecting your investment properties.

Why Use a Legal Structure for U.S. Real Estate?

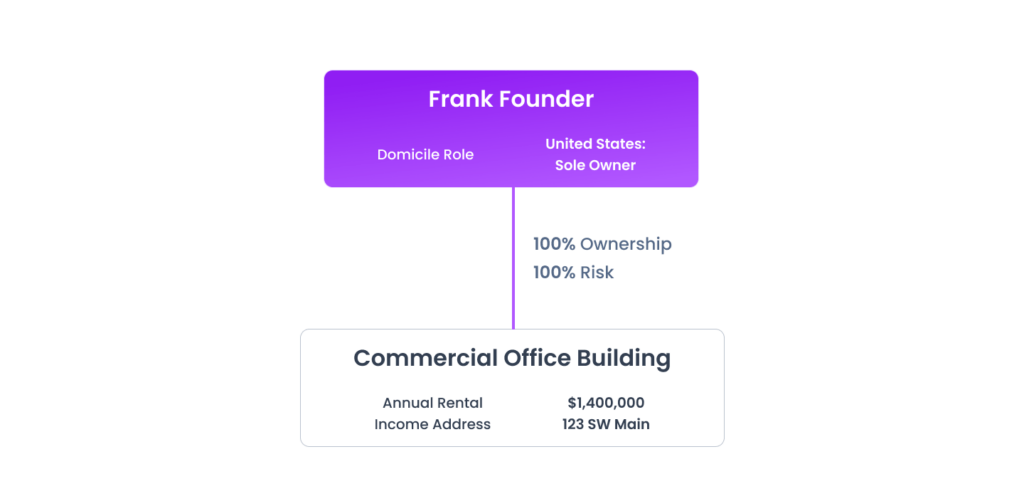

A sole proprietorship is when property is owned under the investor’s name. It is a straightforward, single-owner small business structure that offers the simplest and fastest way to set up a real estate business. However, owning real property under one’s name carries several possible risks.

Any legal claims against the property, such as unpaid taxes or a tenant suing for damages, will be made against the individual owner. This means that personal assets are at stake and could be subject to seizure to satisfy any financial claims. Additionally, without a legal entity in place, it can be challenging for foreign investors to open bank accounts and obtain financing for U.S. real estate investments or other administrative tasks (i.e. closings).

To mitigate these risks, foreign investors may opt for creating a separate entity for their U.S. investment properties instead of using a sole proprietorship. Doing so offers increased legal protections by separating your personal assets from those of the business, so any liabilities related to the property remain with the business itself. Several different structures are available to foreign investors, each with its benefits and drawbacks.

Popular Real Estate Investment Legal Structures

There are three main legal structures for foreign nationals investing in U.S. real estate: Limited Liability Companies, Partnerships, and Trusts. Let’s take a closer look at each.

Limited Liability Company

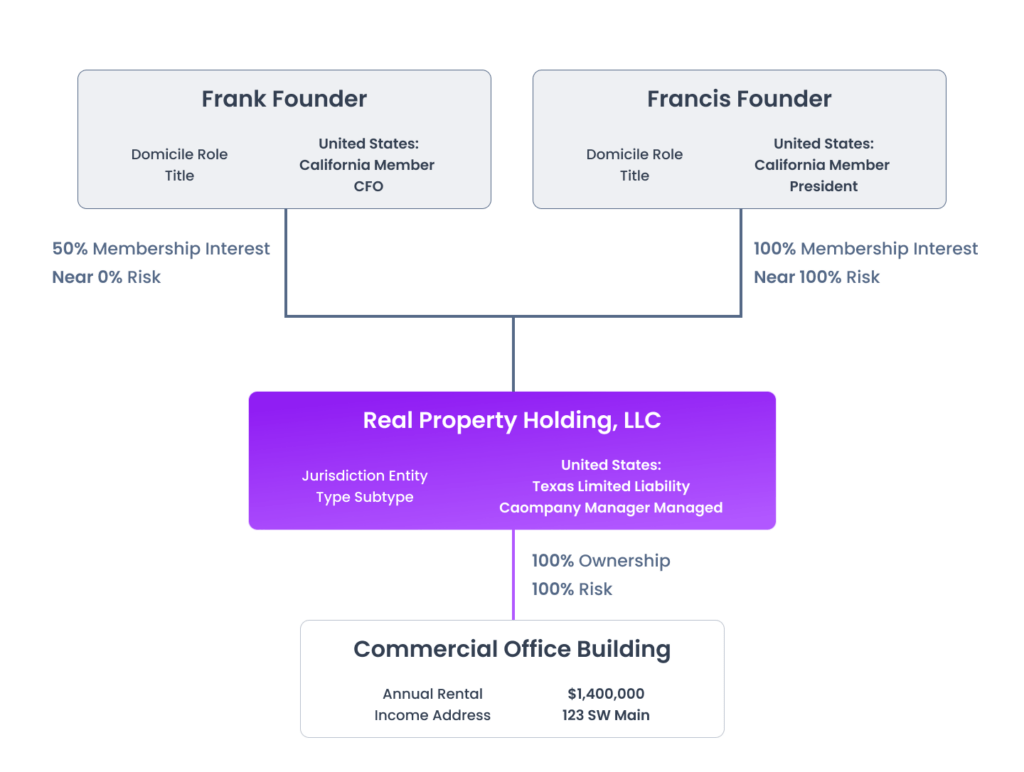

A Limited Liability Company (LLC) is a flexible legal structure for business owners that protects personal and business assets from liabilities. An LLC can have one or more owners, known as members, who can be individuals, corporations, or other LLCs.

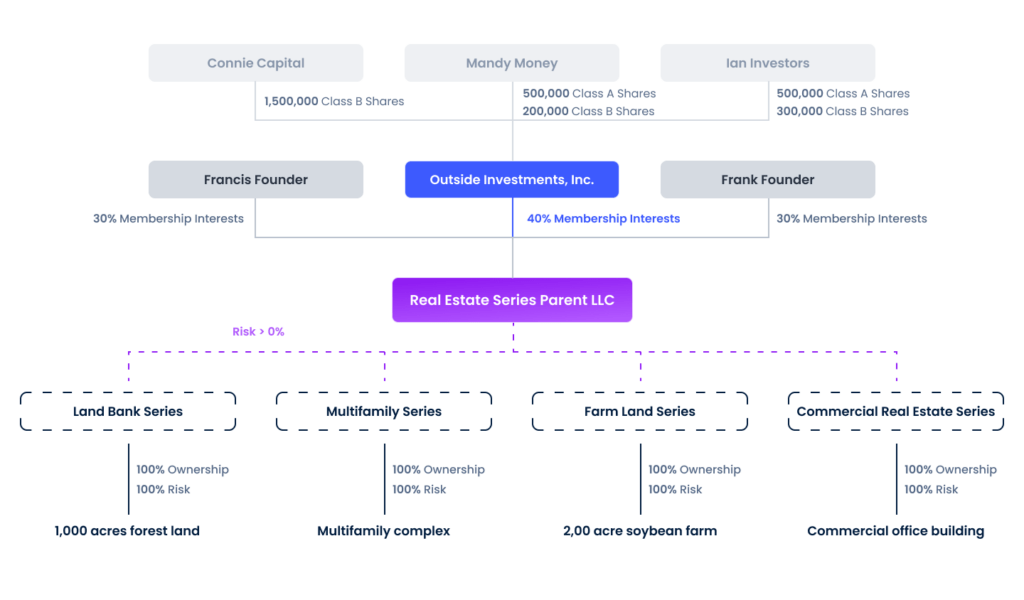

A single-member LLC has only one owner, while a multi-member LLC has two or more owners. A series LLC allows for multiple “series of LLCs” within one larger entity which can operate separately but still benefit from shared resources like accounting services.

Forming and Structuring an LLC

Forming an LLC involves filing articles of organization with the state where the property is located. The articles of organization typically include information such as the name of your LLC, its purpose, and the names of its members. Once approved by the state, an operating agreement should be drafted which outlines how the LLC will be managed and operated.

Managing an LLC

An LLC can be managed by its members or by a designated manager. In member-managed LLCs, each member has an equal say in decision-making unless otherwise stated in the operating agreement. In a manager-managed LLC structure, a designated manager makes all decisions on behalf of the company.

Pros and Cons of an LLC

- Provides personal asset protection for its members. Someone who sues your business generally cannot go after your other personal or business assets.

- LLCs are not taxed at the entity level. Instead, profits, losses, and capital gains pass through to individual members’ income tax returns. So, there is no double taxation.

- One disadvantage is that forming and maintaining an LLC requires some administrative work.

- There are also start-up and annual fees, varying from state to state.

Hague Declaration and Tax Treaties

While it’s safe to say that nobody would complain about not being taxed twice, this rule has some exceptions. Using an LLC as a pass-through vehicle to avoid double taxation only applies to residents of countries that are part of the Hauge Declaration, including Canada, Switzerland, the United Kingdom, and Israel.

This is because the U.S. and foreign governments have agreements allowing foreign citizens to be taxed at a lower rate on certain types of income earned in the United States. These treaties typically provide for reduced rates of withholding taxes on dividends, interest, royalties, capital gains, and other items of income from sources within the U.S.

For foreign real estate investors, understanding the implications of the Hague Declaration and U.S. tax treaties can be invaluable in determining which legal structure to use when holding rental property in the U.S. Consulting with an attorney who specializes in international law is recommended for more detailed information. Investors can also learn more by visiting:

- IRS.gov – irs.gov/individuals/international-taxpayers/tax-treaties

- HCCH.net – hcch.net/en/states/hcch-members

Partnership

A partnership is a business entity where two or more people share ownership of a single property. There are two main types of partnerships: general partnerships and limited partnerships.

The main difference between the two is that with the former, each partner shares equal responsibility for the business’s liabilities and debts. In a limited partnership, one or more general partners manage the property. However, they have lower limited liability protection because of their active roles. Any other limited partner in the business has liability only up to the amount they invested.

Forming and Structuring a Partnership

Forming a partnership involves creating a partnership agreement that outlines the terms of the partnership, including each partner’s responsibilities, the share of profits and losses, and decision-making authority. The partnership agreement should also specify whether the partnership is general or limited.

Managing a Partnership

Partnerships can be managed by all partners collectively or by one designated partner who serves as the managing partner. Each partner has personal liability for any debts or obligations incurred by the partnership.

Pros and Cons of a Partnership

- Partnerships allow for flexibility in management and taxation.

- Income generated by the partnership is reported on individual tax returns rather than at the entity level, which can result in lower overall taxes paid.

- Another advantage is that each partner can bring unique skills and resources to the table, which can help grow the rental property business.

- One disadvantage is that each partner has personal liability for any debts or obligations incurred, depending on how the partnership is structured.

- There might arise succession issues with the death of a partner (in business with Partner’s estate).

- Additionally, there may be challenges with decision-making if partners have differing opinions on how to run the rental property business.

Trusts for Real Estate

Another legal structure foreign nationals may wish to consider is a real estate trust. A trust is a legal entity that can own and manage assets on behalf of its beneficiaries. There are two main types of trusts: grantor trusts and non-grantor trusts.

Before continuing, it’s important to note that foreign nationals investing in U.S. real estate through a trust structure may have different tax implications depending on whether they choose a grantor or non-grantor trust. Therefore, investors must consult with legal and financial professionals before deciding which type of trust is right for them.

Grantor vs. Non-Grantor Trusts

A grantor trust is one where the grantor (investor) retains certain rights over the assets held in the trust, such as control over investment decisions or income generated by those assets. In contrast, with a non-grantor trust, these rights are given up entirely by the grantor.

In a grantor trust, the grantor is typically responsible for paying taxes on any income generated by the assets held in the trust. This means that any rental income earned from U.S. real estate owned by the trust would be reported on the grantor’s personal tax return.

On the other hand, with a non-grantor trust, the trust itself is responsible for paying taxes on its income. The trustee would need to file a separate tax return for the trust and pay any applicable taxes owed.

Forming and Structuring a Trust

To form a trust, the investor (known as the grantor) would need to transfer ownership of their rental property to the trust. The grantor would then appoint a trustee to manage the property on behalf of the beneficiaries.

Regarding structuring the trust, foreign investors may choose to create either a revocable or irrevocable trust. A revocable trust allows the grantor to change or revoke the terms of the trust at any time, while an irrevocable trust cannot be changed once it’s created.

Managing a Trust

Once the trust is established, it’s up to the trustee (who can be an individual or professional entity) to manage and maintain the property on behalf of its beneficiaries. Tasks include collecting rent payments, paying expenses related to the property, and making decisions about repairs or upgrades. It’s important for foreign investors to choose a trustworthy and knowledgeable trustee who understands U.S. real estate laws and regulations.

Pros and Cons of Holding Real Estate in a Trust

- Trusts offer greater asset protection since they are separate legal entities from their beneficiaries.

- Trusts can provide tax benefits and make it easier for foreign investors to pass their assets on to their heirs.

- However, setting up a trust can involve significant upfront costs and ongoing fees for management and administration.

- Trusts may also limit an investor’s control over their assets since they’re managed by trustees rather than directly owned by individuals.

Can Foreign Investors Use Corporate Structures?

In most cases, using a corporate legal structure such as an S Corporation or a C Corporation will not work for foreign nationals because they have to work in the U.S. and show two years of W2 income. This requirement makes it difficult for those who want to invest passively in real estate without actively working in the U.S.

That being said, it’s important to understand the differences between S-corps and C-corps. Both are separate legal entities from their owners and provide shareholder liability protection. However, some differences between them are worth noting.

S-corporations are pass-through entities where profits and losses flow through to the shareholders’ personal tax returns. This means that S-corp shareholders only pay taxes on their share of the company’s income at their individual tax rate. On the other hand, C-corporations are taxed separately from their owners and must file a corporate tax return. Shareholders also pay taxes on dividends received from the corporation.

Overall, while using a corporate structure may not be an option for most foreign investors looking to invest in rental property in the U.S. due to strict requirements, understanding the differences between S-corps and C-corps can still be beneficial when considering different legal structures for your investment portfolio.

Tax Benefits of Getting a Loan Through a U.S. Entity

As a foreign real estate investor, getting a real estate loan through a U.S. entity can have several tax benefits. Firstly, it allows you to take advantage of the U.S. tax system’s rules, such as interest expense deductions and other financing fees, for example, closing costs. Moreover, a legal structure like a Limited Liability Company (LLC) can help you avoid double taxation on your rental income, provided you are a citizen of a country that has a tax treaty with the U.S.

However, it’s important to note that the specific tax benefits will depend on various factors, such as the type of legal structure used, the ownership structure of the entity, and how the rental property is managed. Therefore, consulting with a licensed attorney or tax professional specializing in international real estate investments is always advisable.

Conclusion

The legal structure you choose for holding rental property in the U.S. can significantly impact your investment success. It is important to understand the benefits and drawbacks of each and consult with professionals to determine which option is best for your unique situation. By following these tips and utilizing popular structures for holding property, foreign nationals can better safeguard their investments and achieve long-term financial growth in the U.S. real estate market.