“What are your rates right now?” – This is generally the first question asked today by foreign investors when discussing their financing plans with Lendai representatives. Usually, we receive questions: how can I grow my portfolio? What are the other terms you offer? How fast can you close? What is your experience with working with foreign investors? But the market changed, and with it, the questions that concerned investors.

Here is a bold statement: rates are important and should definitely be a consideration when choosing your lending partner, but they are not the most critical factor, and there are other aspects to consider, especially when discussing an investment property.

In this article, we will discuss the reasoning behind that bold statement.

Let the real estate market guide your decision and not the financing

A great quote about real estate answers the question of when the best time is to buy real estate. “The best time was yesterday. The next best time is today.

“When you’re considering purchasing an investment property, whether you are just starting your journey or are a seasoned investor, the essential aspect to consider is the current market and how you can benefit from it. It would be best if you learned as much as possible about the market you are interested in, the market prices, the market rents, the expenses, your strategy, and much more (stay tuned for more articles on this topic). The bottom line is that the correct information will guide you to success, which can result in a much higher yield.

Rates affect the demand levels in the real estate market, so when rates are low (as seen in the last two years), the market is booming with buyers, driving real estate prices through the roof in every market. In an environment where every listing receives multiple offers and most likely is sold at higher than the asking price, it’s harder to find good investment opportunities.

This is not the case anymore. Higher rates cool the market and create more opportunities for investors who can see beyond the cost of financing. These investors now see a higher cap rate that will only increase with time. Rents are up 12% on average year on year (during Covid, some markets saw up to 40% in rent prices), and the increase and demand do not seem to slow down. The decrease in people who can afford to buy houses affects the demand from buyers, leading to a reduction in home buyers and an increase in the number of renters. The shortage of new homes in the US standsat 3.8 million houses (according to Freddie Mac), and the disruption in the supply chain only adds to the demand for homes to rent.

Combine these factors with the decline in property prices, and you receive a higher cap rate. The same properties that generated 6%-8% annual return can now generate up to 10%-12%. This allows investors to have positive cash flow even in a high-rate environment.

Inflation is your best friend. Sort of…

The hot topic for the last year has been investments during inflation. Annual inflation rates reached as high as 9.1%, creating plenty of fear among investors. Yikes! Simply put, our money is losing 9% of its value just by sitting in the bank.

Real estate is one of the investment options that offer some protection against inflation. So, when considering how to hedge our capital from inflation, the first thought is often to invest in real estate properties. Those properties will generate income and can protect the value of your capital.

You might be thinking, “but you mentioned that the market is heading to a cooldown just now.” Yes, very likely, but unlike stocks where your investment’s value fluctuates according to the market, residential real estate generates the same income (and sometimes more), even if the property’s market value is on the decline. This is because the rental property value (unlike commercial property) is not derived from the income it generates. So when property price change, rents stay the same or go higher. For the most part, rent prices and property prices are affected by different factors. Renters are less likely to demand reduced prices because housing prices went down.

In summary, inflation can erode your capital and buying power, but real estate is one of the best tools to combat it. So, when looking at financing rates, you should also consider the “loss” you are preventing by protecting your capital with property investment.

You date the rate, but marry the investment!

You can improve your cash on cash if the opportunity comes up. Even if you decide to use financing for your investments and the rates drop within the next year, you can refinance and lock in better rates! This is the advantage of a 30-year fixed loan.

Seasoned investors take advantage of the declining market to score properties when there is less competition since there is the option to refinance with lower rates later. This allows them to enjoy the benefits of a great deal and lower the cost in the long term. We worked with many investors who will always start their best investment story: “When everyone was hesitant, I was bold and took advantage….”Financing in a high rates environment will indeed cost you more in the short run, but if you can pull the trigger on a fantastic deal, the internal rate of return (IRR) yield will almost always counter the cost many times over.

It’s important to remember that refinancing a loan has its costs, and there might be a pre-payment penalty (depending on the terms), so the viability should be examined before initiating the process. This is another example of a parameter investors should consider when signing a loan. A short pre-payment penalty or lack of will result in a very flexible stance down the line.

Lock in your value

According to economic publications, property prices are going to decrease. Therefore, investors might want to consider extracting equity from their properties while the value is at its peak. Granted, this will cost you more than a year ago, but the property value is higher, allowing you to extract more cash and use this cash that to generate more income due to the expected decline of the market. When you play your cards right, they can all come together nicely.

Let’s clarify something about this point. That is an asset if you already have a loan on the property at a convenient rate. Do not replace it with a higher-rate loan unless the cash you will extract from this move will allow you to purchase another income-generating property.

Tax deductibles palooza

Uncle Sam has been very kind to foreign investors compared to other real estate markets worldwide. The fact that there are so many tax-deductible expenses, especially when you leverage with financing, makes an investment look and feel much better after tax season.

Each individual has their tax situation, and a CPA will be the best source of information on the subject. The fact that you can deduct all (or most) expenses associated with a loan, including the interest rate throughout the life of the loan, makes a big difference for most investors.

When we examine a property based on the yield vs. the cost, investors should consult with a CPA to determine the actual costs and benefits before making any decisions.

Think like a seasoned investor- Look at the IRR

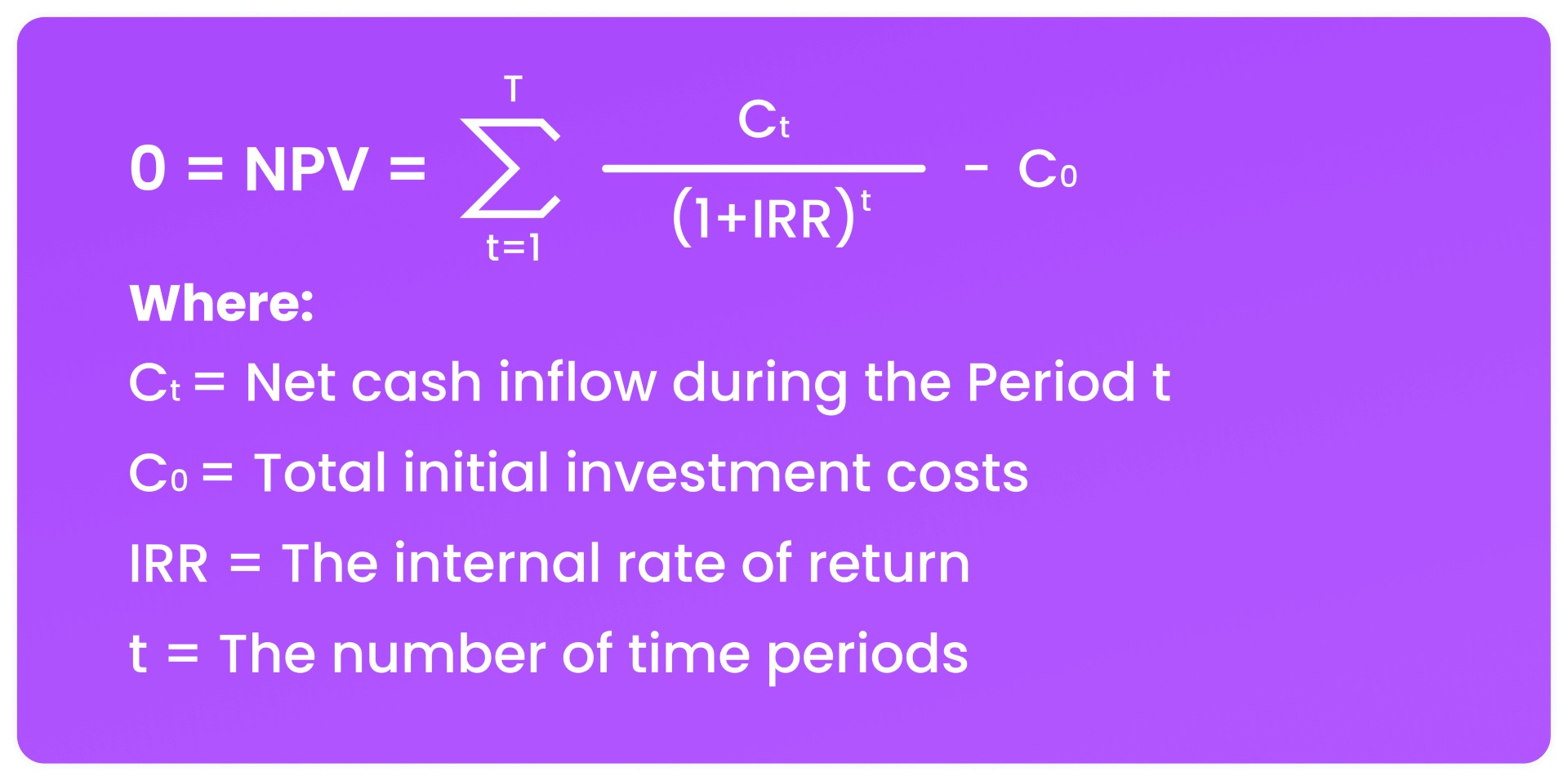

IRR (Internal Rate of Return) is the annual return received from the investment. It is calculated by adding the amount of income generated by the property over a period and the increase in value if the property was sold then.

In other words, if I’m purchasing a property and plan to sell it after ten years, I would look at the year-on-year NOI *10 and add the sale price (deducted from the purchase price and any cost of renovations) and gage my profit (See below the formula). Any other calculation will give you a partial picture.

That means that if I’m taking a loan and comparing the cost of the funds (rates) to the yield (NOI), I’m wrongfully ignoring the vast potential source of revenue that the property generates.

Yes, you will not see it monthly in your bank account, but the fact that it is not there doesn’t mean you’re not profiting. The cumulative profit will be there when you sell the property.

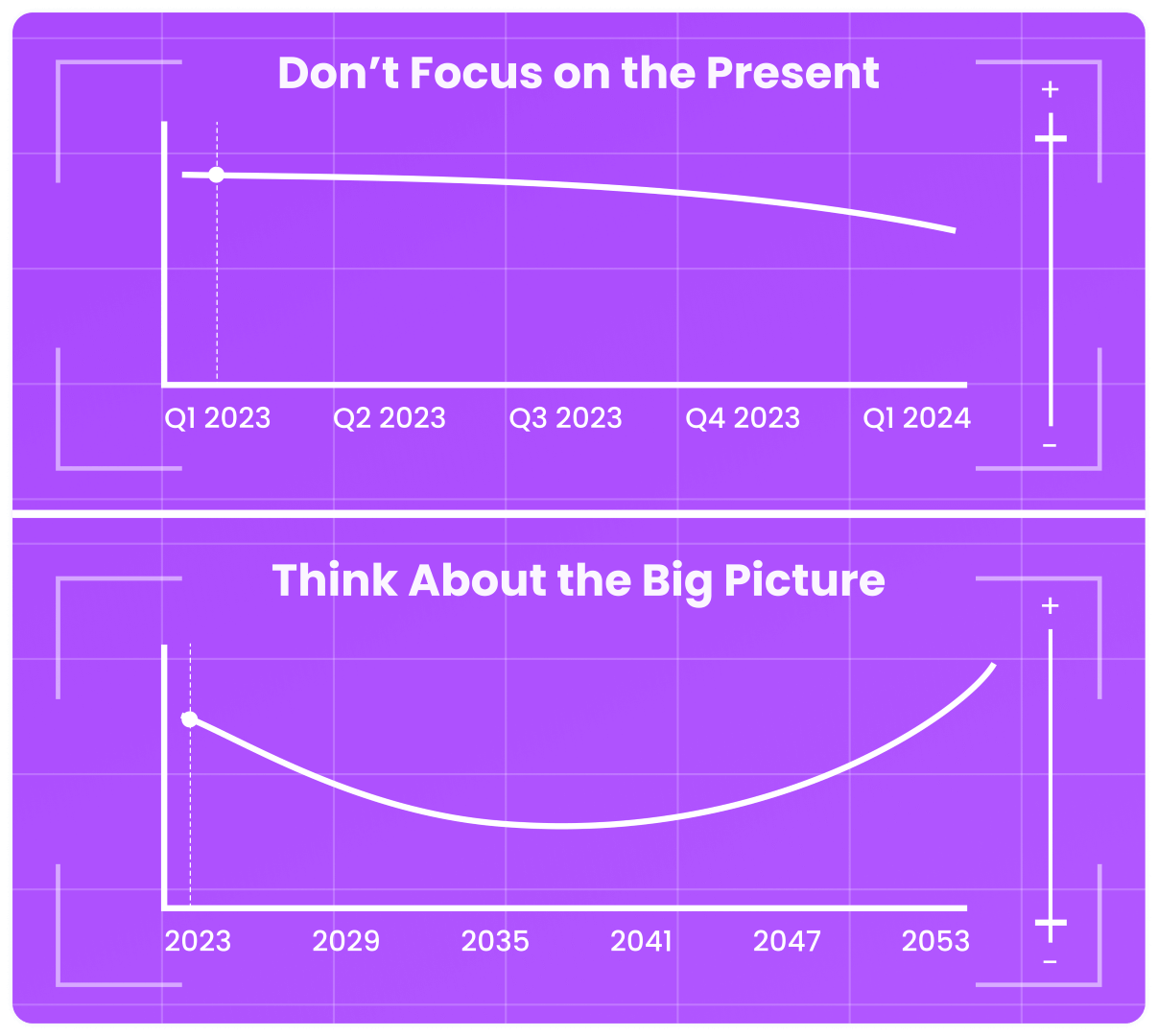

IRR return is more capital-focused and less cash-on-cash return-focused. Hence, a long-term approach to your investment. A seasoned investor rarely looks at the cash-on-cash return for the short term. The overview is always a combination of a long-term view and properties that can hold themselves (at least).

Read this blog article for more information on IRR and how to calculate the viability of the investment.

Build an empire!

Interest rates go up and down throughout the years. Seasoned investors do not let this stop them from growing their portfolios. They are not building a business; they are building an empire.

Accumulating properties is one of the most common ways to generate wealth. Seasoned investors power through times of high and low-interest rates, high and low prices, high and low costs, and income.

When you’re looking to build an empire, the thought process should not include sitting on the fence. There is always a win situation: If interest rates are high – a good opportunity for better-priced opportunities and to extract the most equity. If interest rates are low – a good opportunity to lock in better rates. If costs are low – a good opportunity to invest in renovation and/or new construction. If costs are high – a good opportunity to invest in “buy and hold” properties.

Expanding your portfolio allows you to reduce your vulnerability to changing market circumstances. It is helpful when you have multiple properties, and the income they produce covers any issues. It increases your chances of success and reduces risk by diversifying, which is precisely what financing is about!

A seasoned investor once said that if he did not add five properties to his portfolio every year, it was a wasted year that he would not get back. As he put it, “A lost year I cannot afford. The rates I can.”

You’re on the green even if you don’t feel it.

Build equity with every rent payment you receive! A positive cash flow attitude is healthy but can exclude excellent properties if investors fail to see the big picture and think long-term.

First off, remember to calculate correctly. We briefly touched on this: plenty of investors are calculating their cash-on-cash by comparing the annual NOI to the interest rate. We know that the interest rate is the cost of the loan, which is only 60%-70% of the property value, and the NOI is calculated on 100% of the property cost (+renovations if applicable). So, it’s essential to know what the prices in actual dollars are in addition to percentages.

Another thing to remember is that every loan payment (in a traditional 30-year fixed loan) contains interest and a principal portion. In other words, the interest portion is an expense (deductible), and the principal portion is a profit seen in the sale and not in the cash flow. Every principal payment you make will decrease your debt and leave you with more cash on hand after the sale

Cultivate your ecosystem

There is tremendous value in having a lender in your corner. A good lender knows your market, financial abilities, and limitations. This is a highly valuable part of an investor’s real estate investing ecosystem.

A lender is your partner as it shares your interest in success. The less risk the investment holds, the better for both sides. You, the investor, have access to the lender’s underwriting team, which will conduct the due diligence on the property and let you know if there is any reason for concern or if the investment is a sound one to move forward with.

True, the banks will protect their investment before safeguarding you as a borrower. However, a failed investment is terrible news for both sides. The lender will do anything in its power to avoid getting to that point.

Choosing the right lender is crucial and includes many factors, interest rates being only one. Hence, you should invest time in finding the right lending partner. For example, foreign nationals investing in the US need a lender that knows how to work with foreign investors: which documents to ask, how to prepare for a remote closing, how to overcome issues (that will most likely arise), and how to build a long-term relationship to help them achieve their investment goals.

Faster is better

Speed is essential when dealing with a volatile market. The genuinely great deals (on paper) require a quick closing. Time will kill the deal. That’s why investors need a lender that knows precisely what to ask for, how to process it fast, and how to schedule a closing quickly and effectively.

The process becomes easier and faster once it’s the second, third, or more deals with the same lender. There is a representative that knows the investor, and the investor, in return, already knows what the lender needs. In addition, most documents that do not require updating are already in the system, and the whole process is familiar. Furthermore, your risk factor is lower since the lender knows the investor and their financial strength.

The speed of the process allows the investor to promise and deliver the funds they are committed to in a timely fashion. They are perceived as reliable, trustworthy, and able to lock in on deals that might not have been possible with a long and tedious financing process.

Conclusion

In summary, many factors influence the decision to finance and whom to finance with. Interest rates are important; however, they are just one of an array of factors to be considered in the real estate investment outlook.