Why 2025 Is a Strategic Year to Buy U.S. Investment Properties

July 18, 2025

New Inventory. Better Leverage. Verified Trends Favor Global Buyers.

2025 is not just another year in the U.S. housing market, it’s a turning point, especially for global investors.

After nearly a decade dominated by rapid price growth, intense competition, and limited inventory, the tide is shifting. In just the last few months, inventory has risen sharply across major markets, prices have stabilized, and international buyers are gaining a rare advantage: more choice, more negotiation power, and better financing terms.

At Lendai, we’ve already seen a noticeable uptick in applications from return buyers, foreign nationals who already own a U.S. property and know how difficult the past few years have been. For them, 2025 feels like a window of opportunity opening again.

What We’re Seeing at Lendai

“We have seen a increase in loan pre-approvals from returning investors. What’s different? They’re not competing with 20 other offers anymore. They’re negotiating smarter deals with better terms.”

Our team is working with buyers purchasing single-family rentals, short-term vacation homes, and multi-unit buildings in cities they couldn’t touch just two years ago.

If you’ve been waiting for the market to shift, 2025 is telling you:

It’s time.

U.S. Housing Market in Flux, What the Data Shows (May 2025)

Verified Signals Every International Investor Should Know

Global buyers aren’t just reacting to headlines, they’re reading the data. And in May 2025, the U.S. housing market is sending one clear message: conditions are shifting in favor of buyers.

Across major metros and mid-tier cities, price growth has cooled, inventory has surged, and homes are sitting longer on the market. For international investors, these signals translate into leverage, flexibility, and opportunity.

Here are the key takeaways, based on verified data from Zillow, Redfin, ResiClub Analytics, and other housing intelligence sources:

National-Level Trends

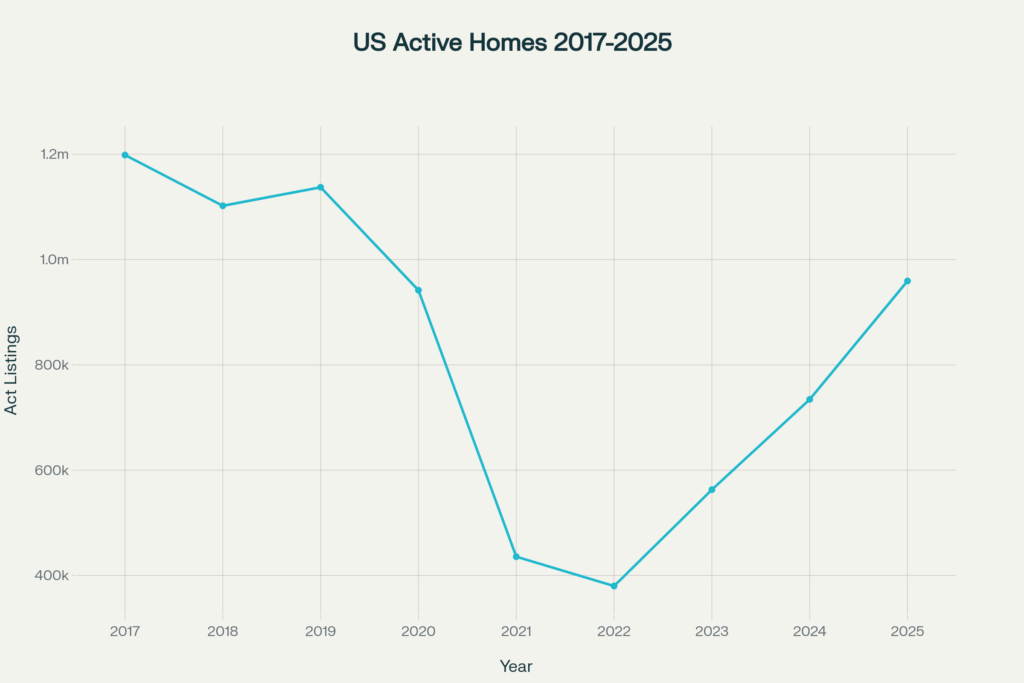

Inventory Surge

According to Zillow’s April 2025 data, active listings in the U.S. housing market grew by 20.8% year-over-year, marking the largest annual inventory increase for April since before the pandemic in 2019. This dramatic rise in available homes gives buyers more options, reduces pressure to act immediately, and allows international investors the time to evaluate better and more strategic deals.

Price Growth Slowing

National home prices rose by just +0.7% year-over-year between April 2024 and April 2025. Even more telling, 27% of U.S. metro areas saw year-over-year price declines during the same period. This cooling indicates a clear shift away from the frenzied seller’s market of the past few years toward a more balanced and buyer-friendly environment, particularly advantageous for well-prepared foreign buyers.

More Price Cuts

In March 2025, 23.5% of all listings had price reductions, according to Zillow, the highest rate for a March since at least 2018. This spike in price adjustments suggests that U.S. sellers are realigning their expectations with market realities, which opens room for negotiation and better value capture for foreign buyers entering now.

Broad Declines

Perhaps most significantly, over 60% of U.S. counties recorded home value declines in May 2025. This widespread softness in pricing has only been seen during two major market moments: the brief 2022 correction and the 2008–2012 housing downturn. For international buyers, this represents a rare moment where pricing trends align with inventory surges, creating ideal conditions to secure deals before the market regains upward momentum.

Regional Hotspots: Where Trends Are Shifting Fastest

Florida & Texas Metros (Tampa, Dallas, Orlando)

Florida and Texas remain two of the most in-demand markets for global investors, but in 2025, they’re experiencing a notable shift. Inventory levels have surged across cities like Tampa, Dallas, and Orlando, giving buyers more leverage than at any point since 2020. Zillow has projected potential price drops of up to 21% in specific overvalued pockets, particularly in areas that saw rapid appreciation during the pandemic. This correction is opening the door for foreign buyers, especially from Canada, Mexico, and Colombia, who were priced out in recent years.

Miami Metro

Miami is seeing one of the most dramatic slowdowns in the country. Home sales have declined by nearly 50% compared to the pandemic peak, and current volumes remain 30% below long-term averages. As of March 2025, there are over 51,000 homes listed for sale in the metro, the second-highest inventory for any U.S. city. For buyers looking for a premium property with long-term potential, Miami is once again negotiable and wide open.

Phoenix

In Phoenix, where prices skyrocketed during the pandemic, home values have now fallen approximately 6.9% from their 2022 peak. This correction is creating space for foreign investors to re-enter a market that was previously too inflated. With inventory stabilizing and fewer bidding wars, Phoenix offers a more rational entry point, especially for buyers seeking medium-term appreciation and rental returns.

Tennessee (Nashville & Knoxville)

Middle Tennessee markets like Nashville and Knoxville are showing early signs of correction. Inventory levels are now the highest they’ve been since 2017–2019, a period that preceded strong value growth. For investors looking beyond the Sun Belt’s top-tier metros, these cities offer lower entry prices, rising rental demand, and room for long-term upside.

What This Means for Foreign Buyers

If you’re based in Canada, Mexico, Colombia, or Israel, and have been priced out in recent years, these indicators matter.

- You can negotiate better deals

- Choose from more properties in better locations

- And take your time to structure financing and legal setup

2025 offers something rare:

A soft landing in a high-demand market.

Financing for Foreign Investors Is More Accessible Than Ever

Lenders Are Competing for Your Business, Even Without a U.S. Credit Score

Historically, foreign nationals faced tough barriers to U.S. real estate financing, no credit history, complex documentation, and limited access to competitive loans.

But in 2025, that’s changing. Cross-border lending is evolving fast, and lenders like Lendai are making it easier than ever for global investors to get funded.

If you’re a non-resident investor from Canada, Mexico, Colombia, Israel, or the UK, here’s what’s working in your favor:

Foreign National Mortgages – What you need to know:

- No U.S. Credit Score Required

Lenders now use global credit profiles and property-level risk metrics instead. - LTV Ratios Up to 70–75%

You can finance up to 75% of the property value in many cases, even for short-term rentals or multi-unit deals. - Fast Pre-Approvals

Thanks to digital underwriting and document automation, pre-approvals now take hours, not weeks. - Flexible Documentation

Use international income, bank statements, or corporate structures, no need for a W-2 or U.S. tax return. - Second Home & Investment Loans Available

Whether you’re buying to rent, Airbnb, or live part-time, there’s a program that fits.

Here is a loan that we closed last week,

Smart Capital. Fast Moves. Zero Borders.

In 2025, the smartest international investors aren’t waiting for the “perfect time”, they’re making strategic moves using the equity they already hold.

Take this real story:

A global investor had spotted the perfect deal, a high-potential property aligned with his long-term strategy. But there was a catch: he had just 20 working days to close, and most of his capital was locked in another U.S. rental property.

Instead of walking away, he turned to Lendai.

He refinanced his existing home in Savannah, Georgia, to unlock equity and fund the new purchase, without selling a single asset. Within just 11 working days, Lendai cleared the loan for closing, and by Day 20, the deal was fully funded.

✔ Capital unlocked

✔ New property acquired

✔ Portfolio growth accelerated

This wasn’t just a fast transaction, it was a textbook example of how global investors can multiply returns with precision financing.

Read the full story: From Equity to Execution in 20 Days

Whether you’re refinancing to scale or applying for your first U.S. mortgage, Lendai’s cross-border lending model gives you speed, flexibility, and peace of mind, even without a U.S. credit score.

Why Now Is the Time to Secure Financing

- Mortgage rates have cooled from 2023 highs, improving long-term affordability

- More lenders are building foreign national programs due to rising demand

- U.S. property markets are more negotiable, making financing the final unlock

And with Lendai, you don’t need a local partner or U.S. presence to move forward.

✅ Get pre-approved in 2 minutes and receive customized loan offers designed for international investors.

Where Smart Money Is Going: Top U.S. Markets for Investment in 2025

Location Matters, And These Cities Are Delivering Cash Flow and Appreciation Potential

In a post-pandemic U.S. housing market, not all cities are created equal.

Savvy global investors aren’t chasing hype, they’re analyzing inventory levels, rental yields, tax policies, and financing flexibility.

Below are the top-performing markets in 2025 for foreign nationals, based on Lendai’s loan activity and third-party data from Zillow, Redfin, and local MLS sources.

| Market | Key Signals (2025) | Primary Foreign Buyers |

| Florida | Inventory surges, price correction unlocking deals in Miami, Tampa | Canada, Colombia, Israel |

| Texas | More supply, seller concessions in Dallas, San Antonio | Mexico, Israel |

| Arizona | Phoenix sees values normalize after pandemic spike | Diverse investor mix |

| Northeast | NY/NJ remain stable, solid rental yield in core boroughs | Israel, UK |

| Emerging | Rising rental yields in Atlanta, Columbus, Cincinnati | Latin America, Canada |

Market-Matching Insight

At Lendai, we match every foreign investor to the best market for their strategy:

- Second-home in Miami?

- Short-term rental in Austin?

- Long-term rental in Atlanta?

You get real-time insights, LTV guidance, and tax strategy support based on your country of origin and goals.

What Could Change Soon:

- U.S. rates may fall further, but that could trigger a demand rebound

- Price reductions are temporary in resilient metros like Florida and Texas

- Institutional investors are watching the same data, and could re-enter soon

- Waiting too long means competing again with domestic and corporate buyers

What Smart Global Investors Are Doing Differently in 2025

Strategies That Separate Smart Buyers From the Rest

Foreign investors aren’t just returning to the U.S. housing market in 2025, they’re getting smarter and more strategic. With lessons from the overheated 2020–2022 market, today’s buyers are making more informed moves to maximize ROI, reduce risk, and grow their portfolios with confidence.

Based on hundreds of active clients from over 50 countries, here’s what the most successful foreign investors are doing now:

Getting Pre-Approved Before House Hunting

Global buyers who get pre-approved with lenders like Lendai have a major edge in today’s market:

- Stronger negotiation power with U.S. sellers

- Ability to close faster, often within 3–4 weeks

- Full clarity on how much they can borrow based on international income and assets

Pro Tip: Pre-approval gives you credibility in a market where U.S. buyers still dominate open houses.

Targeting Cash-Flow-Positive Markets

Rather than chasing appreciation, smart investors are prioritizing:

- High rental yields in cities like Atlanta, Houston, and Columbus

- Lower property taxes (Texas and Florida)

- Properties that perform well as short-term rentals

This helps hedge against price volatility while generating immediate returns.

Structuring with LLCs and Tax Advisors

From day one, experienced global investors are:

- Setting up U.S. LLCs or LPs for ownership and liability protection

- Consulting with U.S. tax professionals familiar with FIRPTA and international treaties

- Keeping documentation clean for smoother financing and future resale

Reminder: Structuring correctly can reduce capital gains exposure and simplify inheritance.

Working With Cross-Border Financing Experts

Rather than struggling with U.S. banks, savvy investors are:

- Partnering with foreign-national lenders like Lendai

- Choosing platforms that don’t require U.S. credit

- Accessing bilingual support and tailored documentation

They’re not trying to force a local loan, they’re using tools built for them.

Diversifying Across Multiple States

Rather than putting everything into one market, experienced buyers are:

- Buying a short-term rental in Florida

- Picking up a long-term unit in Ohio or Texas

- Watching the data, not just the headlines

This allows better portfolio risk management, and taps into different regional economies.

Real Investor Profile

“Daniela from Colombia bought her first condo in Orlando in 2021. In 2025, she used equity growth to finance a second home in Tampa and a duplex in Atlanta. Lendai structured all three loans with a single LLC setup.”

U.S. Tax & Legal Considerations for Foreign Buyers

What Every Global Investor Should Know Before Closing a Deal

Buying property in the U.S. as a foreign national involves more than just choosing the right home and securing a loan, you also need to understand the legal and tax landscape.

Ignoring these can lead to costly mistakes later, especially during resale, inheritance, or income reporting. But with the right setup, it’s easy to stay compliant, protect your assets, and maximize profits.

Read the full article on U.S. Tax Policy Implications for Foreign Real Estate Investors here!

Why You Should Act Now, Not Wait

2025 Is Your Window, The Market Is Listening to Buyers Again

As the data shows, 2025 isn’t just another cycle, it’s a rare alignment of opportunity for foreign investors.

The last few years made it tough: overbidding, tight credit, volatile interest rates, and limited inventory. But now, for the first time since the pandemic boom, the U.S. real estate market is rebalancing, and international buyers like you are in a stronger position than ever.

Markets don’t shout when they bottom, they whisper.

And in 2025, the market is whispering:

“You’ve got time, leverage, and financing. Use them.“

Need a Loan? Have Questions? Let’s Talk.

Whether you’re just exploring or ready to get pre-approved, our team is here to help.

From financing second homes to building rental portfolios, we’ve supported 1,000+ investors from over 50 countries.

*The information contained in this post has been provided by Lend A.I. Ltd. (and/or its affiliates) for information purposes only, and as such, this post shall not be interpreted as legal, tax, professional, or commercial advice. While every care has been taken to ensure that the content is useful and accurate, Lend A.I. (and/or its affiliates) gives no guarantees, undertaking or warranties in this regard, and does not accept any legal liability or responsibility for the content or the accuracy of the information so provided, or, for any loss or damage caused arising directly or indirectly in connection with reliance on the use of such information.