How DSCR Loans Help Foreign Investors Scale in the U.S?

Scaling a real estate portfolio in the United States presents unique challenges for foreign investors. You’ve acquired your first property—perhaps paying cash or using traditional

Scaling a real estate portfolio in the United States presents unique challenges for foreign investors. You’ve acquired your first property—perhaps paying cash or using traditional

Foreign investors eyeing the vast U.S. real estate market face the challenge of researching 50 states and countless cities to find profitable investment opportunities that

In today’s rapidly evolving real estate market, technology is becoming essential for staying competitive and profitable. Fintech (financial technology) startups are creating sophisticated tools specifically

Donald Trump’s return to the White House in 2025 brings significant implications for international commercial real estate investors. His administration’s early policy signals include proposed

Construction costs in the U.S. housing market continue to present challenges for investors in 2025. According to CoreLogic’s February 2025 Construction Cost Update, material costs

Finding the right U.S. city for rental property investment challenges even local Americans—imagine doing it from another country. With 50 states and countless local markets,

Contrary to what many foreign investors believe, you don’t actually need a visa to purchase real estate in the United States. This common misconception has

As a foreign investor eyeing the U.S. real estate market, you may find that traditional financing options don’t always align with your investment strategy. While

For many international real estate investors, the path to acquiring property in the United States seems to lead inevitably through a U.S.based bank. You’ve likely

According to ATTOM Data Solution’s latest U.S. Home Flipping Report, investors earned a 30.4% profit margin nationwide, with typical gross profits reaching $73,500 per flip.

Foreign investors eyeing the U.S. real estate market find themselves at a critical crossroads in 2025. On one side, construction costs continue their upward trajectory.

Foreign nationals eyeing the U.S. real estate sometimes assume that obtaining financing is an insurmountable challenge. However, the reality is quite different. Contrary to popular

Foreign investors frequently encounter a common frustration in the hot U.S. real estate market: missing out on prime properties because they couldn’t secure traditional financing

You’ve probably noticed the buzz around new construction investment in the U.S. From urban high-rises to expanding suburban developments, these fresh properties offer exciting investment

When it comes to investing in the U.S. real estate market, one of the most common questions foreign buyers ask is, “How much do I

If you were among the many investors who enjoyed strong gains in the capital markets over the past year, you may now find yourself with

Imagine you’re an international real estate investor scouring the U.S. for a good deal. One day you spot an undervalued multi-family property in Austin’s thriving

The U.S. real estate market is attracting a growing number of foreign investors. But are you prepared for the seismic shifts potentially heading your way?

Foreign investors in U.S. real estate face unique tax considerations, including potential withholding requirements under the Foreign Investment in Real Property Tax Act (FIRPTA) and

As an international investor eyeing the U.S. real estate market, you might be wondering: “Do I need a U.S. credit score to buy that promising

Bridge loans are a key financing strategy for international investors in the U.S. real estate market. These short-term solutions offer quick capital access, allowing for

Fix and flip loans are a key tool when investing in U.S. real estate. For foreign investors, the fix and flip strategy offers an exciting

As a foreign investor eyeing the US fix & flip market, you’re likely aware that the potential for profit is vast. But there’s one issue

New construction financing for foreign investors is a key strategy for investing in the competitive US real estate market. Loans for new construction, or ground

The Federal Reserve is signaling a potential interest rate cut. You’re keenly aware of the implications, and suddenly find yourself on the cusp of a

There’s one real estate investment strategy that stands out for its dynamic nature and the potential it presents for quick, rewarding returns: fix and flips.

The US real estate market holds a unique allure. It offers a robust economy, a diverse choice of properties, and the promise of significant returns.

The US real estate market offers rich opportunities for Canadian investors. Facilitating these cross-border deals, however, requires a precise understanding of this dynamic landscape. This

In December 2023, Henley and Partners hosted Lendai to discuss investment migration options available in the USA and investing in real estate using AI tools. Watch the session here.

Nestled between the bustling metropolis of New York City and the historic charm of Philadelphia, lies an investment gem – New Jersey, also known as

Discover the art and science of neighborhood analysis for rental property in the US. Learn the steps, tips, and tools for a successful real estate investment.

Missed our recent webinar with Expat Network on “Maximizing Returns: Expert U.S. Real Estate Financing Strategies”? Don’t worry! You can now catch the recorded session

Stay ahead as a mortgage broker! Discover how the demand for financing U.S. real estate from foreign investors can boost your business.

Unlock the potential of real estate investment despite rising interest rates with consistent cash flow from residential rentals and tips for successful investment strategies.

Explore the vibrant market of Colorado investment properties. Learn why the state is attracting foreigners seeking residential rentals in the US.

Investing in U.S. property? Learn the fundamentals of commercial vs. residential real estate in our in-depth blog post.

Lendai to offer LATAM investors a simple, fast, and efficient way to finance their US Real Estate investments

Does Inflation Make Real Estate a Good Investment?. We answer that question by investigating the role inflation plays and how savvy investors leverage it to their advantage.

Find out why investing in Oklahoma real estate could be a wise move for foreign nationals. Read our blog to gain a deeper understanding and make informed decisions.

Get ahead with the strong vs weak dollar for real estate investing by capitalizing on currency fluctuations in the U.S. property market.

Master the language of real estate with our guide to the basic terms used in real estate investment and financing

Discover the benefits and opportunities of Alabama real estate investing and why it’s a favorite among foreign investors.

Learn more about the Real Estate potential of South Carolina’s market to foreign investors looking for rental property.

Learn what to look for in landlord insurance when financing your US rental property investment.

Navigate the Tennessee housing market rental property arena with confidence using our in-depth global investor guide.

Discover the best locations for foreign nationals to buy investment property in Missouri and maximize your returns with our expert insights.

Boost your refinance loan rental property success with solutions designed specifically for foreign nationals investing in US real estate.

Discover the potential of Wisconsin real estate investing for foreign nationals with this comprehensive guide.

Explore Lucrative Ohio Real Estate Opportunities: Uncover the Potential, Prime Locations, and Market Insights in the Buckeye State for Global Investors.

In this article, we will explore the nuances of non-qualified mortgage (non-QM) loans and their potential to unlock exciting investment prospects for foreign investors looking to capitalize on the rental property market in the United States.

Explore Michigan’s real estate trends, stats, and top cities for investments, along with key tips for maximizing ROI in the “Great Lakes State”.

Complete guide for foreigners with no credit history seeking US residential loans. In the article we cover loan options, required documentation and actionable steps that simplifies this, sometimes, complex process.

Discover a comprehensive guide for international buyers interested in purchasing rental property in the USA. An essential resource for overseas investors and foreign nationals looking to expand their investment property portfolios.

Home365 will now offer complete turn-key solution to international real estate investors including Lendai lending solutions.

Home365 will now offer complete turn-key solution to international real estate investors including Lendai lending solutions.

Are you a foreign national looking to invest in properties located in Pennsylvania? Get started on your investment journey with this comprehensive guide from Lendai.

Learn why Arizona’s thriving economy and diverse real estate market make it a prime destination for foreign investors.

Our esteemed panel of industry experts who discusses the best practices for maximizing profits in the STR lucrative market, the latest trends and techniques for optimizing rental income, and tips for foreign investors.

Our esteemed panel of industry experts discusses the best practices for maximizing profits in the STR lucrative market, the latest trends and techniques for optimizing rental income, and tips for foreign investors.

Wondering what the best legal structure is for holding rental property in the United States? This article covers LLCs, corporations, and partnerships.

Are you interested in investing in real estate in Georgia? Learn more about the benefits and potential of this U.S. state, and what to consider before making the decision to invest.

Wondering what the best legal structure is for holding rental property in the United States? This article covers LLCs, corporations, and partnerships.

Want to know more about investing in Indiana real estate? This guide for foreign investors covers the Hoosier state’s top housing markets.

rates are important and should definitely be a consideration when choosing your lending partner, but they are not the most critical factor, and there are other aspects to consider, especially when discussing an investment property.

Join us as we explore the ever-changing and dynamic US real estate market with our esteemed panel of experts! From navigating an uncertain economy to analyzing potential opportunities, these professionals provide insight into how investors can expand their portfolios for success.

Grow your portfolio of vacation rental properties! Learn the ins and outs of investing in short-term rentals in 2023, including best practices, market trends, and tips for foreign real estate investors

Join us as we explore the ever-changing and dynamic US real estate market with our esteemed panel of experts! From navigating an uncertain economy to analyzing potential opportunities, these professionals provide insight into how investors can expand their portfolios for success.

Michal Liviatan, Lendai’s Canda Head of Partnerships, was featured in the Top 100 People in Finance. Read the full feature here.

Are you interested in investing in short-term rentals? This guide will introduce you to the basics of this unique real estate investment opportunity.

Looking to invest in North Carolina real estate? Get tips for maximizing cash flow and creating an income stream. Learn about trends and opportunities, and risks involved.

Are you a foreign real estate investor considering options to finance property in the US? If so, it’s important to know about pre-payment penalty (PPP) buyout options.

Are you looking to invest in Texas real estate? This overview will give you all the information you need including market prices, rental potentials and economic growth

Wondering if investing in a condo is a good idea? In this post, we explore the pros and cons of condos to help you make an informed decision.

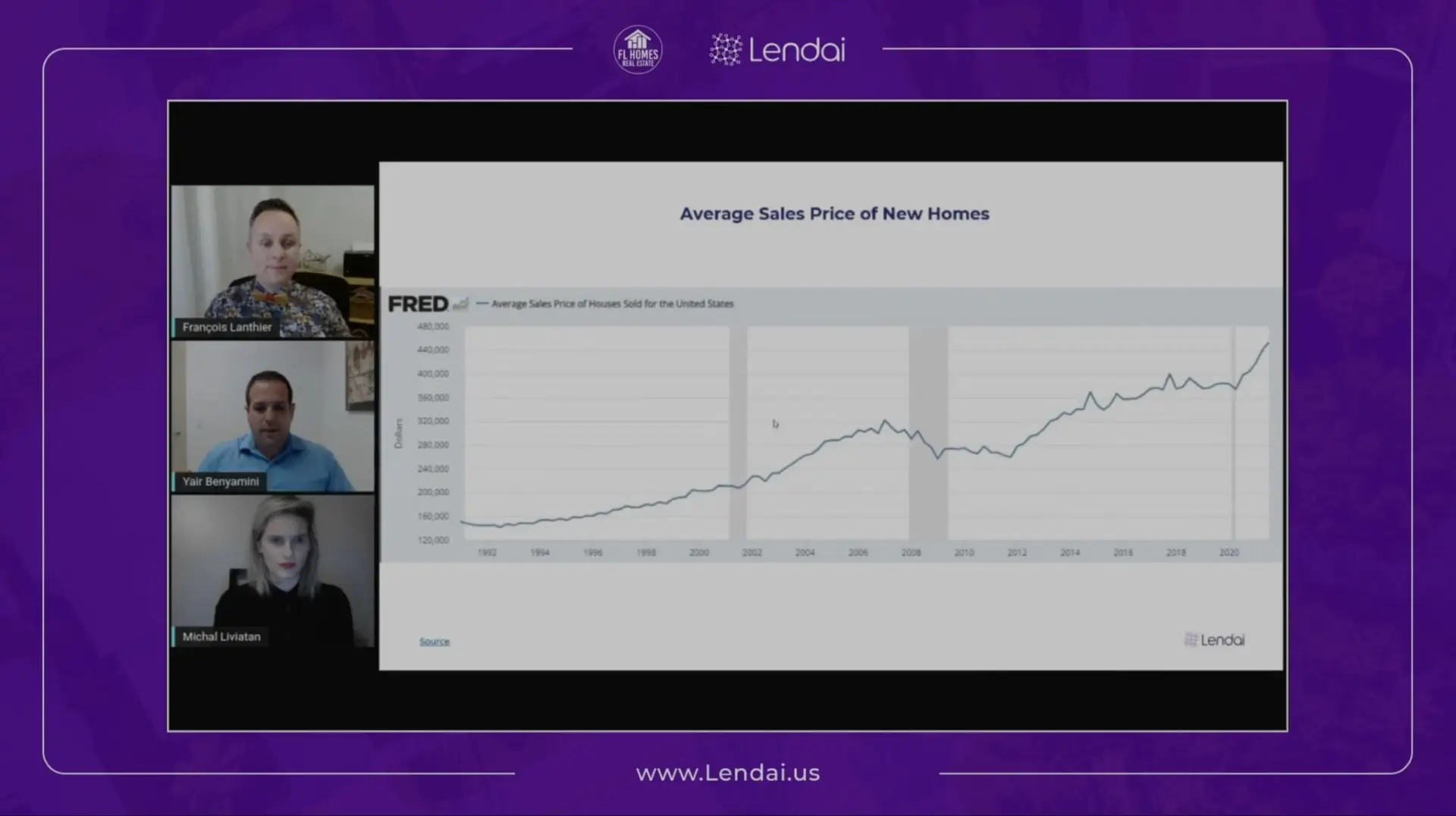

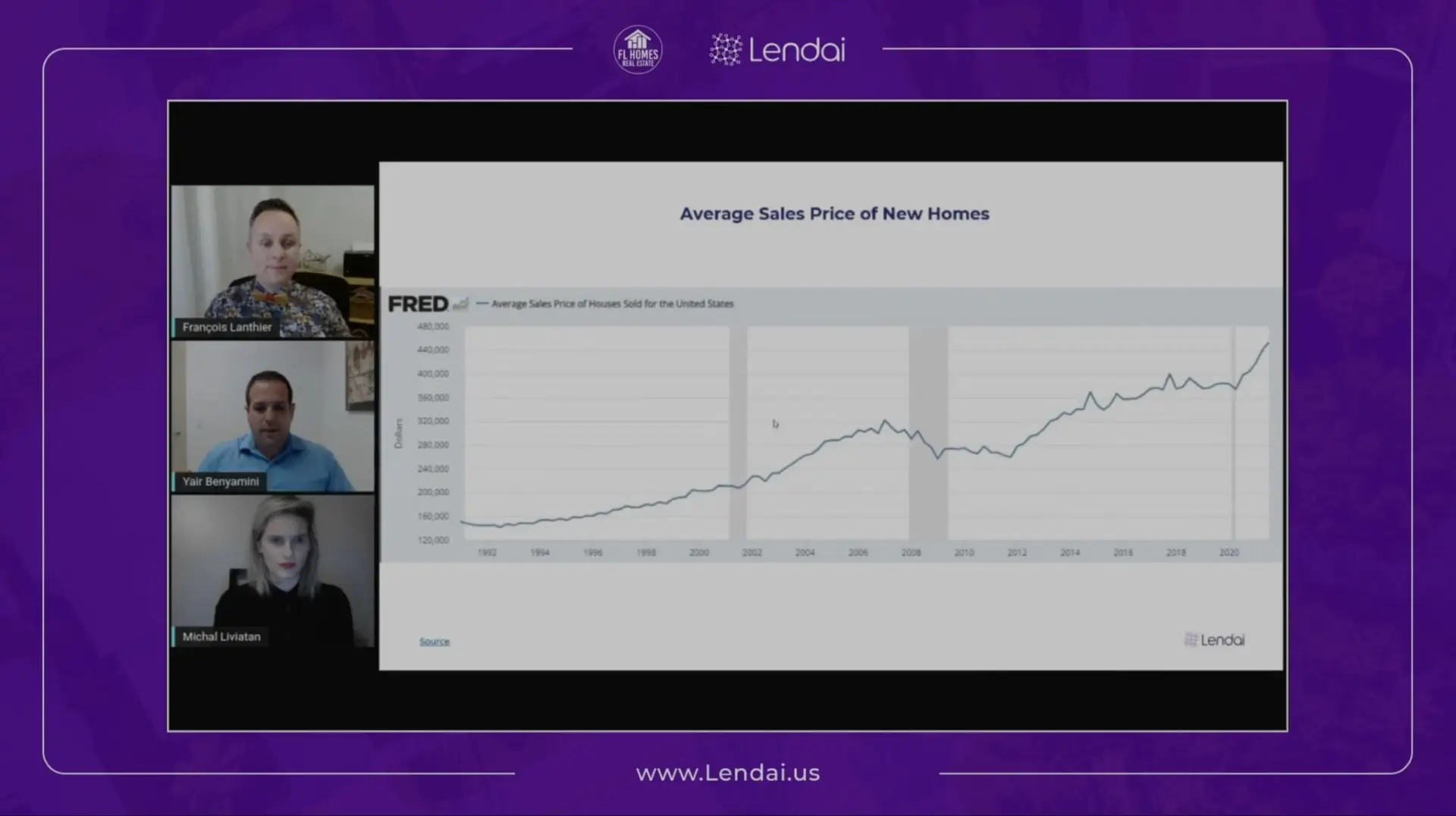

On February 27, François Lanthier hosted Lendai to discuss south of the border funding options for Canadian real estate investors. Watch the session here.

The Florida residential market is the third-largest market in the United States at the state level, as it houses a population of 21,477,737, according to July 2019 estimates

What buyers and brokers need to know about mortgage financing in the U.S.

What buyers and brokers need to know about mortgage financing in the U.S.

Financial-technology startup Lendai enables foreign borrowers investing in non-residential US real estate properties the ability to efficiently and quickly access financing and competitive rates…

On February 27, François Lanthier hosted Lendai to discuss south of the border funding options for Canadian real estate investors. Watch the session here.

A new app is making it easier for foreign investors to buy real estate in the United States.

Known as Lendai, the platform is described as the first to enable foreign and nonresident investors to finance US properties via an online mortgage approval process.

Yair Benyamini, Co-Founder and CEO at Lendai, shares insights after reading “Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!..

The U.S. housing market is the largest private real estate market in the world, and the U.S. mortgage market is the largest private debt market in the world. An industry that’s no stranger to innovation, it has always been at the cutting edge, helping it attract patronage from all over the…

Lendai, the leading AI-based fintech portfolio lender, partners with Lendlord to bolster non-US investing in the US residential real estate market.

Israeli fintech company Lendai has announced the completion of a $35 million financing round in equity and debt seed funding. The round was led jointly by Meron Capital and Cardumen Capital, with participation from Discount Capital, Skywell Capital Partners, Mindset Ventures, and Viola Credit.

Financial technology startup firm Lendai announced Wednesday that it has raised $35 million in equity and debt seed funding. The purpose of the company is to enable foreign, non…

This additional funding will let the company let foreign, non-residential borrowers investing in U.S. real estate properties access immediate funding and competitive rates using its artificial intelligence (AI)-based Triple Digital Underwriting System, which aims to make…

On March 3, Lindsey Stewart from Star Dynamic hosted Lendai to learn how Australians can work with lenders to fund their US property investments

On February 27, François Lanthier hosted Lendai to discuss south of the border funding options for Canadian real estate investors. Watch the session here.

The Florida residential market is the third-largest market in the United States at the state level, as it houses a population of 21,477,737, according to July 2019 estimates

The Savannah residential market is the third-largest metropolitan market in Georgia with a total population of 393,353 as of July 2019. The area’s population has been growing at the third-fastest rate in the state and well above the national growth rate over the last 10 years.

The Cleveland metropolitan area is the third largest in Ohio in terms of population and the 50th largest in the United States. With a population of slightly over 2 million, the Cleveland residential market offers a wide range of investment choices both in terms of price ranges, structure types, and locations.

If you are a US real estate investor, then getting your property or properties insured should be a top priority. Not only is it a requirement for most lenders, but taking out the right insurance policies could possibly save you from financial loss and even ruin down the road.

The Atlanta residential market is one of the 10 largest markets in the United States and the third-largest in the Southeast. According to the July 2019 estimates by the U.S. Census Bureau, the Atlanta metropolitan area was ranked 9th in terms of population size, which was estimated at 6,020,364.

In order to choose between investing in Real Estate relative to another investment, we will use several indicators and estimates.

Before using these estimates, we need to calculate expenses and income.

Why is a Title Company important when buying Real Estate in the United States? Title companies are a great American invention that reduce the risks when investing in Real Estate in the US.

USA Office

1000 Brickell Avenue, Suite 715-418,

Miami, FL 33131

20900 NE 30th Ave suite 200 12, Aventura, FL 33180, United States

Canada Office

100 King St W, Suite #5700,

Toronto, ON M5X 1A9

Israel Office

Moshe Sharet 6, Rishon LeZion,

Israel 7570427

UK Office

83 Baker St, London W1U 6AG,

United Kingdom

India Office

114A Primus Building, Plot No SP–7A, Guindy Industrial Estate, Chennai 600032, India